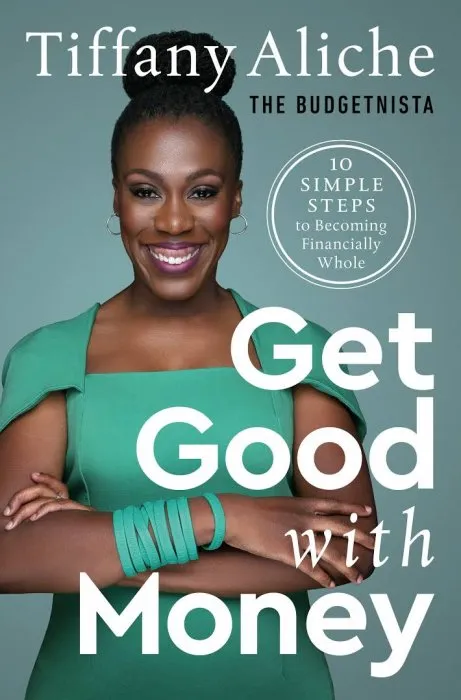

Get Good with Money: Ten Simple Steps to Becoming Financially Whole

Date: March 30th, 2021

ISBN: 0593232747

Language: English

Number of pages: 368 pages

Format: EPUB

Add favorites

A ten-step plan for finding peace, safety, and harmony with your money—no matter how big or small your goals and no matter how rocky the market might be—by the inspiring and savvy “Budgetnista.”

“No matter where you stand in your money journey, Get Good with Money has a lesson or two for you!”—Erin Lowry, bestselling author of the Broke Millennial series

Tiffany Aliche was a successful pre-school teacher with a healthy nest egg when a recession and advice from a shady advisor put her out of a job and into a huge financial hole. As she began to chart the path to her own financial rescue, the outline of her ten-step formula for attaining both financial security and peace of mind began to take shape. These principles have now helped more than one million women worldwide save and pay off millions in debt, and begin planning for a richer life.

Revealing this practical ten-step process for the first time in its entirety, Get Good with Money introduces the powerful concept of building wealth through financial wholeness: a realistic, achievable, and energizing alternative to get-rich-quick and over-complicated money management systems. With helpful checklists, worksheets, a tool kit of resources, and advanced advice from experts who Tiffany herself relies on (her “Budgetnista Boosters”), Get Good with Money gets crystal clear on the short-term actions that lead to long-term goals, including:

• A simple technique to determine your baseline or “noodle budget,” examine and systemize your expenses, and lay out a plan that allows you to say yes to your dreams.

• An assessment tool that helps you understand whether you have a “don't make enough” problem or a “spend too much” issue—as well as ways to fix both.

• Best practices for saving for a rainy day (aka job loss), a big-ticket item (a house, a trip, a car), and money that can be invested for your future.

• Detailed advice and action steps for taking charge of your credit score, maximizing bill-paying automation, savings and investing, and calculating your life, disability, and property insurance needs.

• Ways to protect your beneficiaries' future, and ensure that your financial wishes will stand the test of time.

An invaluable guide to cultivating good financial habits and making your money work for you, Get Good with Money will help you build a solid foundation for your life (and legacy) that’s rich in every way.

“No matter where you stand in your money journey, Get Good with Money has a lesson or two for you!”—Erin Lowry, bestselling author of the Broke Millennial series

Tiffany Aliche was a successful pre-school teacher with a healthy nest egg when a recession and advice from a shady advisor put her out of a job and into a huge financial hole. As she began to chart the path to her own financial rescue, the outline of her ten-step formula for attaining both financial security and peace of mind began to take shape. These principles have now helped more than one million women worldwide save and pay off millions in debt, and begin planning for a richer life.

Revealing this practical ten-step process for the first time in its entirety, Get Good with Money introduces the powerful concept of building wealth through financial wholeness: a realistic, achievable, and energizing alternative to get-rich-quick and over-complicated money management systems. With helpful checklists, worksheets, a tool kit of resources, and advanced advice from experts who Tiffany herself relies on (her “Budgetnista Boosters”), Get Good with Money gets crystal clear on the short-term actions that lead to long-term goals, including:

• A simple technique to determine your baseline or “noodle budget,” examine and systemize your expenses, and lay out a plan that allows you to say yes to your dreams.

• An assessment tool that helps you understand whether you have a “don't make enough” problem or a “spend too much” issue—as well as ways to fix both.

• Best practices for saving for a rainy day (aka job loss), a big-ticket item (a house, a trip, a car), and money that can be invested for your future.

• Detailed advice and action steps for taking charge of your credit score, maximizing bill-paying automation, savings and investing, and calculating your life, disability, and property insurance needs.

• Ways to protect your beneficiaries' future, and ensure that your financial wishes will stand the test of time.

An invaluable guide to cultivating good financial habits and making your money work for you, Get Good with Money will help you build a solid foundation for your life (and legacy) that’s rich in every way.

Download Get Good with Money: Ten Simple Steps to Becoming Financially Whole

Similar books

Information

Users of Guests are not allowed to comment this publication.

Users of Guests are not allowed to comment this publication.