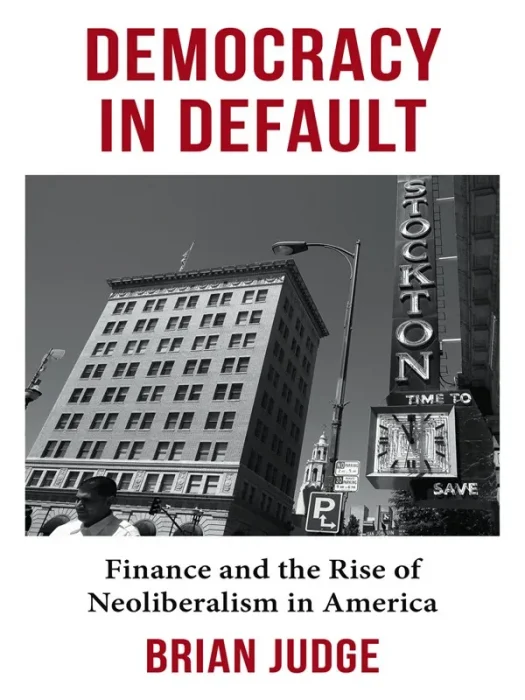

Democracy in Default: Finance and the Rise of Neoliberalism in America

Date: March 20th, 2024

ISBN: 0231213999

Language: English

Number of pages: 352 pages

Format: EPUB

Add favorites

How did neoliberalism arise? Faced with the crises of the 1970s, a coalition of neoliberal intellectuals, conservative politicians, and business interests carried out a vast project of walling off the economy from democracy, ensuring the dominance of finance—or so the conventional story goes. Democracy in Default offers a new perspective on the birth of neoliberalism, showing that this common narrative confuses cause and effect. Financialization was not the offspring of deregulation but the mechanism that allowed neoliberalism to take root.

Brian Judge argues that financialization was a nearly spontaneous response to a crisis within liberalism. He examines how liberalism disavows the problem of distributive conflict, leaving it vulnerable when those conflicts erupt. When the postwar growth engine began to slow, finance promised a way out of the resulting political impasse, allowing liberal democracies to depoliticize questions of distribution and sustain the existing social and economic order. Elected officials were not simply captured or co-opted but willingly embraced financial solutions to their political problems. Unleashing the financial imperative to generate monetary returns, however, ushered in an all-encompassing transformation. Vivid case studies—the bankruptcy of Stockton, California; the investment strategy of the California Public Employees' Retirement System; and the 2008 financial crisis—illustrate how the priorities of financial markets radically altered liberal democratic governance. Recasting the political and economic transformations of the past half century, Democracy in Default offers a bracing new account of the relationship between neoliberalism and financialization.

Brian Judge argues that financialization was a nearly spontaneous response to a crisis within liberalism. He examines how liberalism disavows the problem of distributive conflict, leaving it vulnerable when those conflicts erupt. When the postwar growth engine began to slow, finance promised a way out of the resulting political impasse, allowing liberal democracies to depoliticize questions of distribution and sustain the existing social and economic order. Elected officials were not simply captured or co-opted but willingly embraced financial solutions to their political problems. Unleashing the financial imperative to generate monetary returns, however, ushered in an all-encompassing transformation. Vivid case studies—the bankruptcy of Stockton, California; the investment strategy of the California Public Employees' Retirement System; and the 2008 financial crisis—illustrate how the priorities of financial markets radically altered liberal democratic governance. Recasting the political and economic transformations of the past half century, Democracy in Default offers a bracing new account of the relationship between neoliberalism and financialization.

Download Democracy in Default: Finance and the Rise of Neoliberalism in America

Similar books

Information

Users of Guests are not allowed to comment this publication.

Users of Guests are not allowed to comment this publication.